U.S. equities were mixed on Friday but ended generally higher following a string of up and down days on Wall Street as investors pondered the route forward for interest rates and fresh sanctions against Russia. The Dow Jones Industrial Average finished the day 0.30 percent higher; the S&P 500 finished 0.44 percent higher, and the Nasdaq Composite finished the day -0.09 percent lower.

Even while negotiations between the two countries are still ongoing, Ukrainian troops continue to oppose. This situation undoubtedly causes commodity prices to rise more, particularly oil prices, which remain above $100 per barrel. High global oil costs cause worldwide inflation rates to rise further, weighing on the economic progress of every country on the planet.

The yield on 10-year US bonds has reached 2.4 percent, while the yield on 5-year bonds has reached 2.5 percent, indicating that market participants’ views on long-term uncertainty are beginning to emerge. The Inverted Yield Curve is an indicator of a coming economic recession, as market players are beginning to mistrust the long-term payment of government bonds due to the war in Ukraine, rising oil costs, and the Fed’s aggressive stance of raising interest rates this year.

Furthermore, the threat of a recession has prompted many investors to convert their financial instrument holdings into cash and cryptocurrencies such as bitcoin.

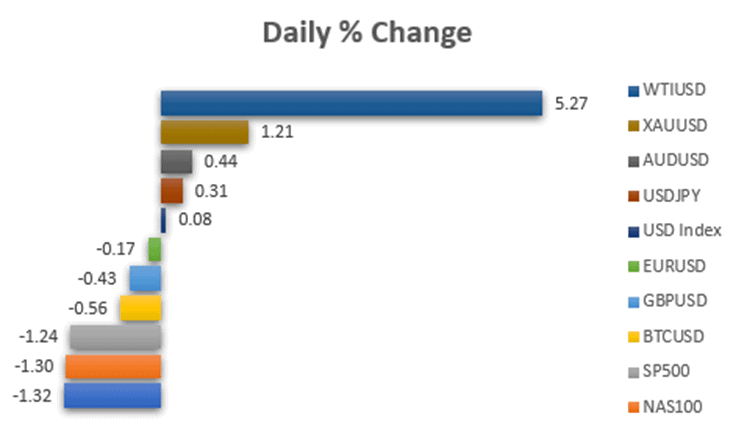

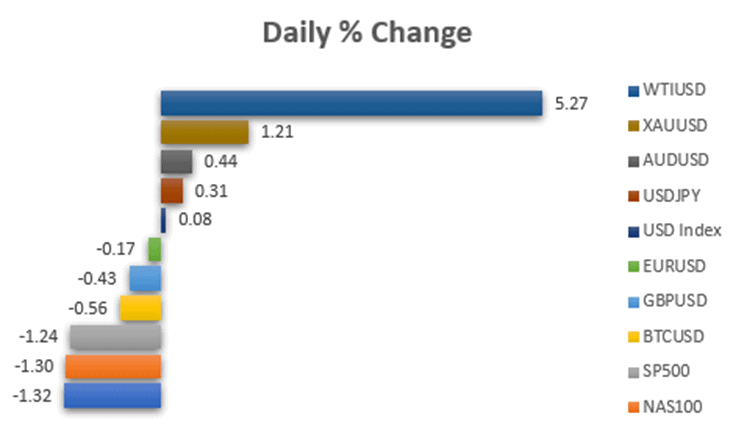

Main Pairs Movement

We can notice some market activity based on MT4 from VT Markets over the last week.

The US Dollar was up 8.44 percent, Bitcoin was up 7.97 percent, and Apple stock was up 6.28 percent.

Meanwhile, the USDJPY increased by 2.57 percent, and the XAUUSD increased by up to 1.85 percent.

The SP500 was up 1.72 percent and the NAS100 was up 2.31 percent on the US Index.

Technical Analysis

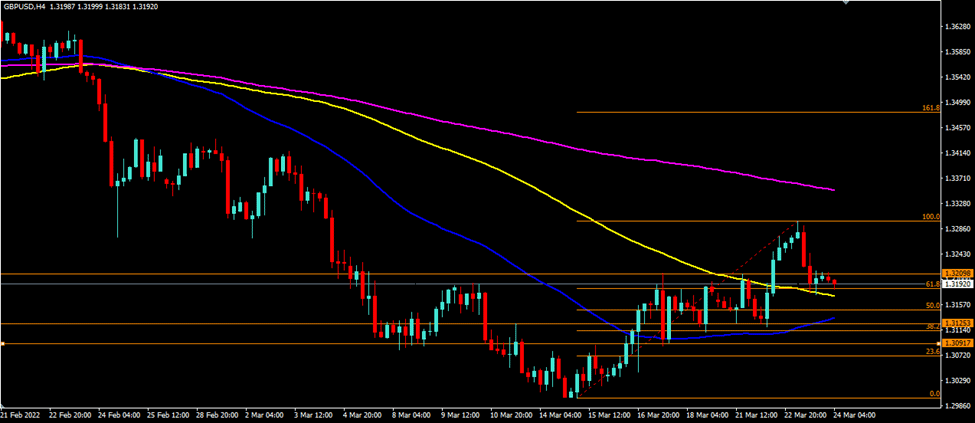

GBPUSD (4-Hour Chart)

The cable remains pretty solid; our resistance level of 1.3209 has not been broken, but upward momentum is weakening as we approach our next resistance area of 1.3269 – 1.3300. The cable is presently approaching our support areas of 1.3125 and 1.3150. On the four-hour chart, the cable is trading below its 50- and 200-day simple moving averages (SMAs), but above its 100-day SMA.

Resistance: 1.3209, area 1.3269 – 1.3300

Support: 1.3125-1.3150

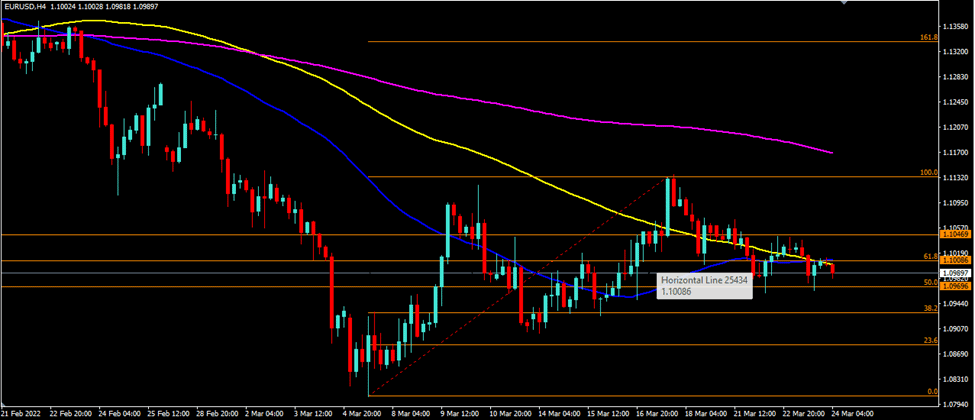

EURUSD (4-Hour Chart)

The EURUSD is unable to hold above our resistance level of 1.1008 and is falling back below it, breaking below 1.0969, which we can mark as our nearest resistance. The nearest support levels for the EURUSD are around 1.0925 and 1.0899. On the four-hour chart, EURUSD is currently trading below its 50-day, 100-day, and 200-day simple moving averages (SMAs).

Resistance: 1.0969, 1.1008

Support: 1.0925, 1.0899

XAUUSD (4-Hour Chart)

XAUUSD fell down below our 61.8 Fibonacci level of $1953 per ounce, as well as our resistance level of $1948 per ounce. For today, we can choose $1948 – $1953 per ounce as our nearest resistance level, with the next resistance levels at $1974 and $2000 per ounce. In the meantime, our support levels will be set at $1921 per ounce. On the four-hour chart, XAUUSD is now trading above its 50-day and 200-day SMAs but below its 100-day SMA.

Resistance: area $1948 – $1953, $1974, $2000

Support: $1921

Giáo dục

Công ty

Câu hỏi thường gặp

Khuyến mãi

Cảnh báo rủi ro: Giao dịch CFD có mức độ rủi ro cao và có thể không phù hợp với tất cả các nhà đầu tư. Đòn bẩy trong giao dịch CFD có thể làm tăng lãi và lỗ, có khả năng vượt quá vốn ban đầu của bạn. Điều quan trọng là phải hiểu đầy đủ và thừa nhận các rủi ro liên quan trước khi giao dịch CFD. Hãy xem xét tình hình tài chính, mục tiêu đầu tư và mức độ chấp nhận rủi ro của bạn trước khi đưa ra quyết định giao dịch. Hiệu suất trong quá khứ không phải là dấu hiệu của kết quả trong tương lai. Tham khảo các tài liệu pháp lý của chúng tôi để hiểu toàn diện về rủi ro giao dịch CFD.

Thông tin trên trang web này mang tính chung chung và không tính đến các mục tiêu, tình hình tài chính hoặc nhu cầu cá nhân của bạn. VT Markets không thể chịu trách nhiệm về tính liên quan, chính xác, kịp thời hoặc đầy đủ của bất kỳ thông tin trang web nào.

Các dịch vụ và thông tin của chúng tôi trên trang web này không được cung cấp cho cư dân của một số quốc gia nhất định, bao gồm Hoa Kỳ, Singapore, Nga và các khu vực pháp lý được liệt kê trong danh sách trừng phạt toàn cầu và FATF. Chúng không nhằm mục đích phân phối hoặc sử dụng ở bất kỳ địa điểm nào mà việc phân phối hoặc sử dụng đó trái với luật pháp hoặc quy định của địa phương.

VT Markets là một thương hiệu có nhiều đơn vị được ủy quyền và đăng ký ở nhiều khu vực pháp lý khác nhau.

· VT Markets (Pty) Ltd là Nhà cung cấp dịch vụ tài chính (FSP) được ủy quyền được đăng ký và quản lý bởi Cơ quan quản lý ngành tài chính (FSCA) của Nam Phi theo giấy phép số 50865.

· VT Markets Limited là đại lý đầu tư được ủy quyền và quản lý bởi Ủy ban Dịch vụ Tài chính Mauritius (FSC) theo số giấy phép GB23202269.

VT Markets Ltd, được đăng ký tại Cộng hòa Síp với số đăng ký HE436466 và địa chỉ đăng ký tại Archbishop Makarios III, 160, Tầng 1, 3026, Limassol, Síp, chỉ hoạt động như một đại lý thanh toán cho VT Markets. Tổ chức này không được ủy quyền hoặc cấp phép ở Síp và không tiến hành bất kỳ hoạt động được quản lý nào.

Bản quyền © 2025 VT Markets.