Market Focus

The Fed currently buys $120 billion in bonds every month to inject liquidity into the financial system. The Fed is expected to scale back its bond purchase program starting this month and develop a plan to stop buying bonds in the middle of the next calendar year.

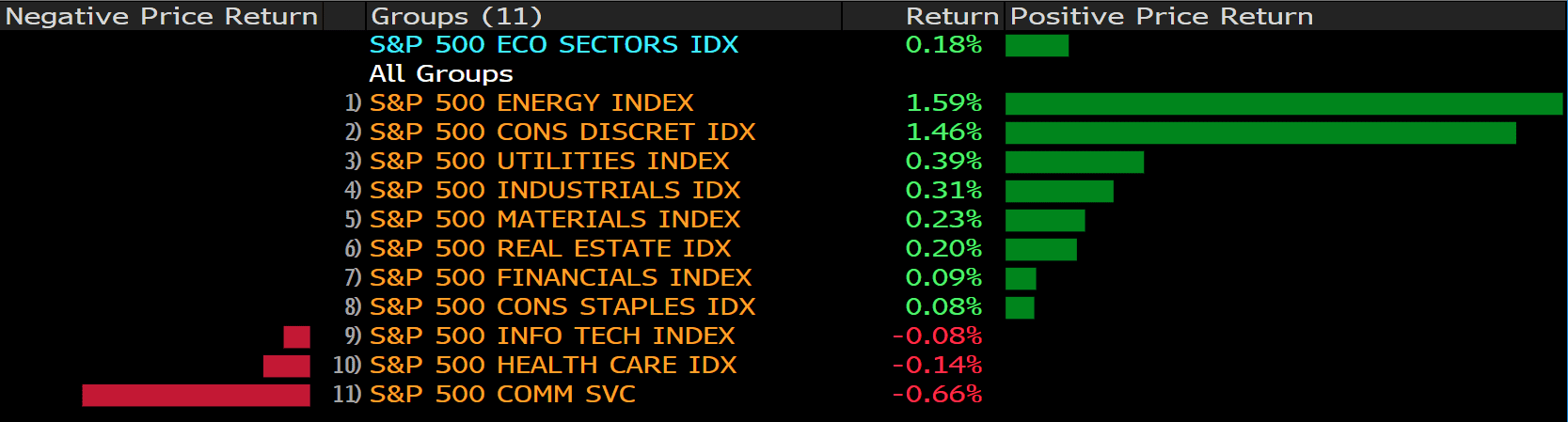

In view of the strong performance announced by companies, all three benchmark US indexes closed at historical highs. The Dow Jones Index rose 0.39%, the S&P 500 Index rose 0.37%, and the Nasdaq Composite Index rose 0.34%. 83% of S&P 500 companies that have announced results have exceeded analysts’ continued optimistic earnings expectations.

Bed Bath & Beyond Inc. surged in the late trading after announcing accelerated stock repurchase and launching a new digital market for third-party producer goods. Lyft Inc. reported third-quarter revenue 73% higher than last year, and the shares went up 8% on the result. Avis Budget Group Inc. has soared in a series of retail frenzy as the car rental company said it will play an important role in the adoption of electric vehicles in the United States. Tesla’s stock price fell by 0.72% because Elon Musk expressed doubts about Hertz Global Holdings’ plan to purchase 100,000 electric vehicles and downplayed the potential of the deal.

Main Pairs Movement:

After the Federal Reserve announced its monetary policy, the U.S. dollar fell slightly against most of its major competitors at the close of trading on Wednesday. As expected, the U.S. central bank kept interest rates unchanged and announced a monthly reduction of $15 billion in asset purchases. The Federal Reserve will begin to reduce the size of U.S. Treasury bond purchases by US$10 billion and reduce mortgage-backed securities by US$5 billion later this month. In addition, policymakers still believe that inflation will be “temporary,” although Powell pointed out that supply chain problems may continue into next year, which means that inflation will also remain high.

The EUR/USD currently still stayed in the continuation pattern, and the currency pair still cannot break through 1.1615. Later in the day, the Manufacturing PMIs will be released, which might provide some clear direction for pairs following step.

The US dollar index reversed Monday’s decline and rose 0.22% in trading yesterday. The US dollar index was flat and rose 2 basis points in early trading today. The U.S. 10-year Treasury bond yield is 1.55%.

Technical Analysis:

The pair EUR/USD edged higher on Wednesday, ending the slide that started yesterday. The pair was trading higher in early Asian session and then bears started to take over during European session. But EUR/USD is currently rebounding back toward 1.158 area, paring most of its intraday loss. The pair stays in positive territory amid weaker US dollar across the board, despite the US ADP report showed the US economy added 571K jobs during October. This report will influence expectations from Friday’s official Nonfarm Payrolls. On top of that, investors are waiting for ECB’s action with their expectations of a probable lift-off sooner than anticipated.

For technical aspect, RSI indicator 46 figures as of writing, suggesting tepid bear movement ahead. The MACD also falls below the signal line, which means the pair is likely to experience downward momentum. If we take a look at the Bollinger Bands, the price is falling from the moving average after touch it, which also means that the bearish momentum is likely to persist. In conclusion, we think market will be bearish as long as the 1.1613 resistance line holds.

Resistance: 1.1613, 1.1692, 1.1755

Support: 1.1535, 1.1425

After plummeting to two-week low yesterday, The pair AUD/USD rebounded moderately in early trades on Wednesday, but failed to preserve its bullish traction and now flirting around 0.7425 area at the time of writing. A less hawkish Reserve Bank of Australia and upbeat Chinese’s macro data assisted AUD/USD to gain some traction earlier today. On top of that, the Fed is scheduled to announce its monetary policy decision later during the American session as well as Fed Chair Jerome Powell’s comments at the press conference. If they are hawkish, AUD/USD could declined further. AUD/USD was last seen trading at 0.7419, posting a 0.12% loss for the day.

For technical aspect, RSI indicator 32 figures as of writing, suggesting that the pair is surrounding by heavy selling now. As for the MACD indicator, the negative histogram also indicates a possible downward trend for the pair. Looking at the Bollinger Bands, price is sitting between the moving average and the lower band, therefore the pair is likely to experience downward momentum. In conclusion, we think market will be bearish as the pair is now testing the 0.7421 support and chances are high that it could break it, which will open the door for additional near-term losses.

Resistance: 0.7502, 0.7556

Support: 0.7421, 0.7379, 0.7324

The pair XAU/USD tumbled on Wednesday amid strong US jobs data, sitting in negative territory for a second day. The pair dropped to a three-week low and now flirting just under 1764 level. The better-than-expected ADP report acted as a tailwind for the greenback and weighed heavily on the XAU/USD pair. A upbeat ADP estimate usually increases the chance the NFP report is going to be strong, which may trigger a more hawkish Fed. Market focus now shifts to the Fed announcement later in the session, as investors expect the Fed to announce its bond tapering plans.

For technical aspect, RSI indicator 28 figures as of writing, suggesting that the pair is in oversold zone, investors should be aware of a trend reversal. The MACD also falls below the signal line, which indicates a bear market. As for the Bollinger Bands, price is moving out of the bands so a strong trend continuation can be expected. In conclusion, we think market will be bearish as the pair is trying to test the 1750.24 support..

Resistance: 1796.40, 1813.83, 1834.04

Support: 1750.24, 1721.74

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

GBP |

Construction PMI (Oct) |

17:30 |

52.0 |

||||

|

GBP |

BoE Inflation Report |

20:00 |

|||||

|

GBP |

BoE Interest Rate Decision (Nov) |

20:00 |

0.10% |

||||

|

USD |

Initial Jobless Claims |

20:30 |

275K |

||||

|

EUR |

ECB President Lagarde Speaks |

21:00 |

|||||

|

GBP |

BoE Gov Bailey Speaks |

22:15 |

|||||