The S&P 500 and Nasdaq Composite extended their winning streaks, marking their longest runs in nearly two years, while the Dow Jones Industrial Average also notched a seven-day winning streak. Technology stocks and semiconductor companies experienced gains as yields dropped, and a cooling off in oil prices contributed to improved sentiment around inflation. Wall Street is closely monitoring the sustainability of this rally after a strong performance in November. In the currency market, the US dollar rebounded, while other major currencies faced challenges influenced by central bank comments and economic growth concerns.

On Tuesday, the S&P 500 and Nasdaq Composite continued their winning streaks, marking their longest run in nearly two years and building on November’s positive momentum. The S&P 500 advanced by 0.28% to close at 4,378.38, while the Nasdaq surged by 0.9% to end at 13,639.86. The Dow Jones Industrial Average edged up by 0.17%, adding 56.74 points to settle at 34,152.60. The S&P 500 recorded a seventh consecutive day of gains, a feat it had last achieved in November 2021 with an eight-day winning streak, while the Nasdaq extended its winning streak to eight days, reminiscent of its 11-day streak in November 2021. The Dow also notched a seven-day winning streak, marking its longest run since July. The rise in technology stocks was attributed to falling yields, with the 10-year Treasury note’s yield dropping by approximately 9 basis points to 4.573%. Tech giants like Amazon, Salesforce, Apple, Microsoft, and Meta Platforms experienced gains, and semiconductor stocks like Advanced Micro Devices, Broadcom, and Intel rose in anticipation of funding from the Chips Act. A cooling off in oil prices also contributed to improved sentiment around inflation.

Wall Street is keeping a close watch on the sustainability of the previous week’s rally, which was the best in 2023 for all three major indices. In November, the Dow saw a 3.3% increase, while the S&P and Nasdaq surged by 4.4% and 6.1%, respectively, so far this month. Additionally, the market is awaiting insights from central bank speakers, including Federal Reserve Chair Jerome Powell, and quarterly results from companies like Disney, Wynn Resorts, and Occidental Petroleum are expected later in the week. Despite some uncertainties, the market showed momentum and follow-through from the previous week’s gains, and investors are closely monitoring whether the positive trend can continue.

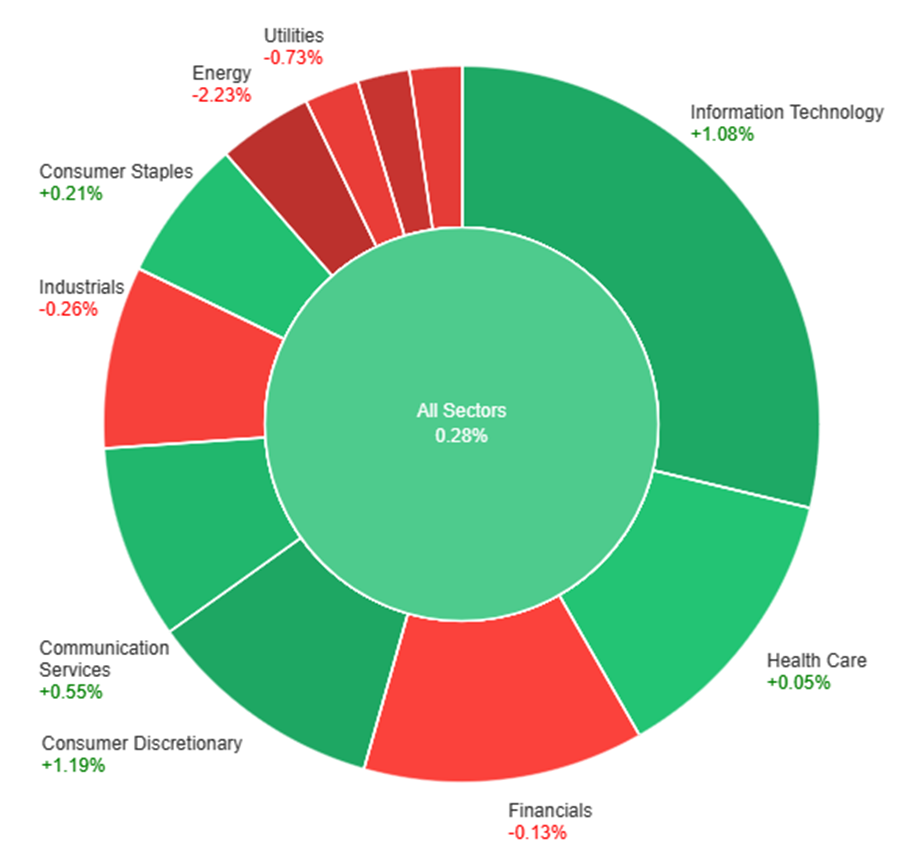

Data by Bloomberg

On Tuesday, across all sectors, the market experienced a modest increase of 0.28%. Consumer Discretionary and Information Technology sectors outperformed the market with gains of 1.19% and 1.08%, respectively, while Communication Services and Consumer Staples also saw positive growth, with 0.55% and 0.21% gains. In contrast, the Energy sector had the most significant decline, plummeting by 2.23%, followed by Materials, which dropped by 1.87%. The Real Estate and Utilities sectors also saw declines of 0.88% and 0.73%, respectively. Financials and Industrials experienced more modest losses of 0.13% and 0.26%. Meanwhile, the Health Care sector had the smallest increase at 0.05%.

Currency Market Updates

In recent currency market updates, the US dollar experienced a notable rebound, with the dollar index rising by 0.36% on the back of broad-based gains. This recovery came as a correction following a post-payrolls drop, partly triggered by an unexpected 1.4% decrease in German industrial output and earlier risk-off flows, which had boosted demand for the safe-haven US currency. The EUR/USD currency pair saw a decline of 0.3%, though it found support just ahead of the 55-day moving average, which it had breached after the release of a weaker-than-expected US jobs report the previous Friday. Key insights from Federal Reserve speakers hinted at a reluctance to commit to imminent interest rate cuts and instead emphasized the possibility of future rate hikes should the current labor market cooling and inflationary trends persist. Traders and investors are now closely monitoring comments from Federal Reserve Chair Jerome Powell, scheduled for Wednesday and Thursday, for further guidance. Additionally, the dollar’s advance slowed as Treasury yields slipped, despite better-than-expected results from a 3-year Treasury auction.

While the US dollar was gaining strength, other major currencies faced challenges. Sterling, for example, slid by 0.44%, influenced by comments from the Bank of England’s Chief Economist Huw Pill, who suggested that a rate cut could be considered around mid-2024. This outlook caused 2-year gilts yields to drop by 7 basis points. The Australian and Canadian dollars also faced losses, falling by 1% and 0.5%, respectively, effectively erasing the gains they had made on Friday. The Australian dollar found some support near its 55-day moving average. These declines were driven, in part, by what was perceived as a dovish stance on rate hikes by the Reserve Bank of Australia, coupled with a decrease in commodity prices. Overall, these currency market developments occurred amidst broader concerns about global economic growth, as evidenced by a 3.5% drop in crude oil prices, along with decreases in the prices of copper and gold.

EUR/USD Rebounds from Lows as Dollar Loses Momentum Amid Volatile Treasury Yields

In Tuesday’s trading, the EUR/USD initially dipped but later recovered, reaching the 1.0700 area. This correction was primarily driven by a stronger US Dollar, which lost its upward momentum due to increasing risk appetite and a reversal in Treasury yields. A negative report from Germany, showing a 1.4% contraction in Industrial Production in September, contributed to the Euro’s earlier decline. However, Eurostat’s Producer Price Index remained in line with expectations. The US Federal Reserve’s focus on data-guided decisions and an upcoming speech by Chair Jerome Powell will influence the Dollar’s trajectory. The volatile Treasury market played a significant role in shaping the Greenback’s movements, ultimately favoring the EUR/USD’s rebound and maintaining bullish sentiment.

According to technical analysis, the EUR/USD moved slightly lower on Tuesday, reaching the middle band of the Bollinger Bands. Currently, the EUR/USD is trading around the middle band, indicating the potential for a consolidating move around the middle band. The Relative Strength Index (RSI) is at 55, signaling that the EUR/USD is back in neutral bias.

Resistance: 1.0711, 1.0765

Support: 1.0675, 1.0615

US Dollar Surge Temporarily Pressures Gold (XAU/USD) as Fed Hints at Further Rate Hikes

Gold (XAU/USD) faced downward pressure, falling to $1,956.65 per troy ounce, as the US Dollar gained strength due to cautious market sentiment, spurred by Federal Reserve (Fed) officials suggesting the possibility of additional rate hikes to address inflation concerns. However, the Greenback’s gains were trimmed later in the day as US stock markets rebounded, while US Treasury yields remained relatively subdued.

According to technical analysis, XAU/USD moves lower on Tuesday and is able to reach the lower band of the Bollinger Bands. Presently, the price of gold is moving near the lower band, creating a possibility to push lower. The Relative Strength Index (RSI) is currently at 38, indicating a slight bearish bias for the XAU/USD pair.

Resistance: $1,992, $2,007

Support: $1,962, $1,945

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| NZD | Inflation Expectations q/q | 10:00 |