On Tuesday, stock markets experienced a sharp decline due to concerns among traders about contagion in the regional banking sector ahead of the Federal Reserve’s rate decision. The Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite all fell for a second consecutive session. Bank shares also declined, with the SPDR S&P Regional Banking ETF dropping more than 6%. Traders were questioning the stability of smaller regional financial institutions, including PacWest and Western Alliance, which declined by 27% and 15%, respectively.

The Federal Reserve’s two-day policy meeting, which began on Tuesday, is expected to result in the announcement of another quarter-point rate hike on Wednesday. Traders are pricing in a roughly 85% chance of a rate hike. Investors will be looking for clues about whether the Fed will keep rates steady after this meeting or further tighten monetary policy to fight inflation. Additionally, the U.S. Treasury warned on Monday that the country may hit the debt ceiling sooner than expected, which weighed on market sentiment.

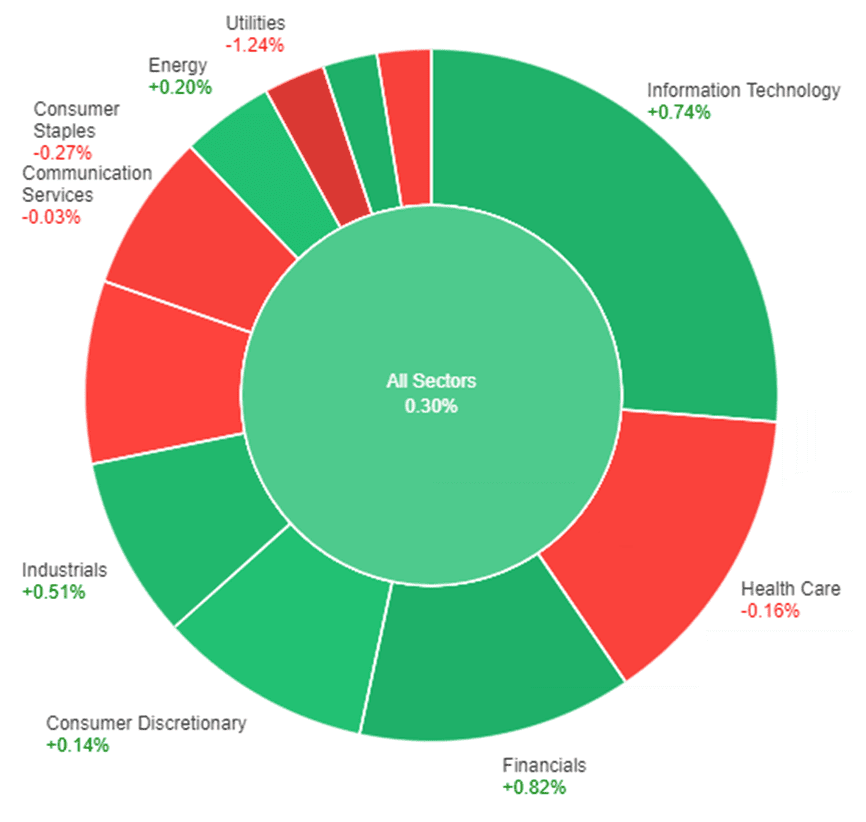

On Tuesday, all sectors in the stock market experienced a decline of 1.16%. Among the sectors, energy was hit the hardest with a decline of 4.28%, followed by financials at 2.30%. Real estate and communication services also experienced significant drops of 1.74% and 1.78%, respectively. The remaining sectors also showed negative results, with consumer staples down 0.32%, health care down 0.49%, and information technology down 0.93%. Consumer discretionary was the only sector to show a slight increase of 0.16%.

Major Pair Movement

The US dollar index declined on Tuesday as below-forecast JOLTS and plummeting regional bank stocks caused Treasury yields to fall, resulting in renewed recession fears. The dollar lost ground against the yen, euro, and Swiss franc, while high beta currencies suffered. USD/JPY fell 0.67% as the S&P regional banking index dropped around 7% to its lowest level since May 2020. EUR/USD recovered from its risk-off lows and gained roughly 0.29% despite disappointing eurozone bank lending data, the first fall in core inflation since January 2022, and an unexpectedly large 2.4% drop in German retail sales. The focus is now on Wednesday’s ISM non-manufacturing and ADP releases, followed by the Fed’s announcement, which is expected to include a 25bp hike. The Fed will also have the Q1 loan officer survey and ongoing banking concerns to ponder beyond inflation and labor data.

Technical Analysis

EUR/USD (4 Hours)

The EUR/USD rose, breaking a two-day losing streak and reaching 1.1000, due to risk aversion in the market following a decline in stocks on Wall Street. The US JOLTS report showed lower-than-expected numbers. The Eurozone’s inflation rate in April increased slightly, with the core HICP dropping to 5.6%. The ECB is expected to raise interest rates on Thursday, with a 25 basis points hike predicted, but there are concerns about the potential risks of a 50 bps hike. The Q1 Bank Lending Survey revealed tight credit standards and a slowdown in credit demand. The Fed will make its decision on monetary policy on Wednesday, with a 25 basis points rate hike expected.

Based on technical analysis, the EUR/USD pair has experienced a slight upward movement and has successfully reached our previous resistance level. The current price is now situated above the middle band of the Bollinger band and is trying to reach the upper band. It is anticipated that the EUR/USD will reach our resistance level at 1.1026. The Relative Strength Index (RSI) is currently at 56, indicating that the EUR/USD is in a bullish mode.

Resistance: 1.1026, 1.1068

Support: 1.0984, 1.0962

XAU/USD (4 Hours)

The price of spot gold (XAU/USD) rose to a three-week high of $2,019.33 per troy ounce as the US dollar weakened due to disappointing US data and falling government bond yields. Stock markets fell amid concerns about the banking system, leading to increased demand for the safe-haven metal. The European Central Bank’s Bank Lending Survey showed a fall in demand for credit and tightening lending standards for companies. A group of US lawmakers urged the Federal Reserve to halt its rate hikes amid concerns about job losses and small businesses. The JOLTS Job Openings survey showed a decline in vacancies and an increase in layoffs, while Factory Orders rose slightly in March. US Treasury yields also fell as investors sought safety.

Based on technical analysis, the XAU/USD has moved back up and reached the resistance levels. It is currently situated at the upper band of the Bollinger Band and attempting to push even higher. The Relative Strength Index (RSI) is currently at 67, indicating that the XAU/USD may continue to rise and is currently in a bullish mode.

Resistance: $2,024, $2,035

Support: $2,006, $1,993

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| NZD | Employment Change | 06:45 | 0.8% (Actual) |

| NZD | Unemployment Rate | 06:45 | 3.4% (Actual) |

| NZD | RBNZ Gov Orr Speaks | 09:00 | |

| USD | ADP Non-Farm Employment Change | 20:15 | 148K |

| USD | ISM Services PMI | 22:00 | 51.8 |

| USD | FOMC Statement | 02:00 (4th May) | |

| USD | Federal Funds Rate | 02:00 (4th May) | 5.25% |

| USD | FOMC Press Conference | 02:30 (4th May) |