Market Focus

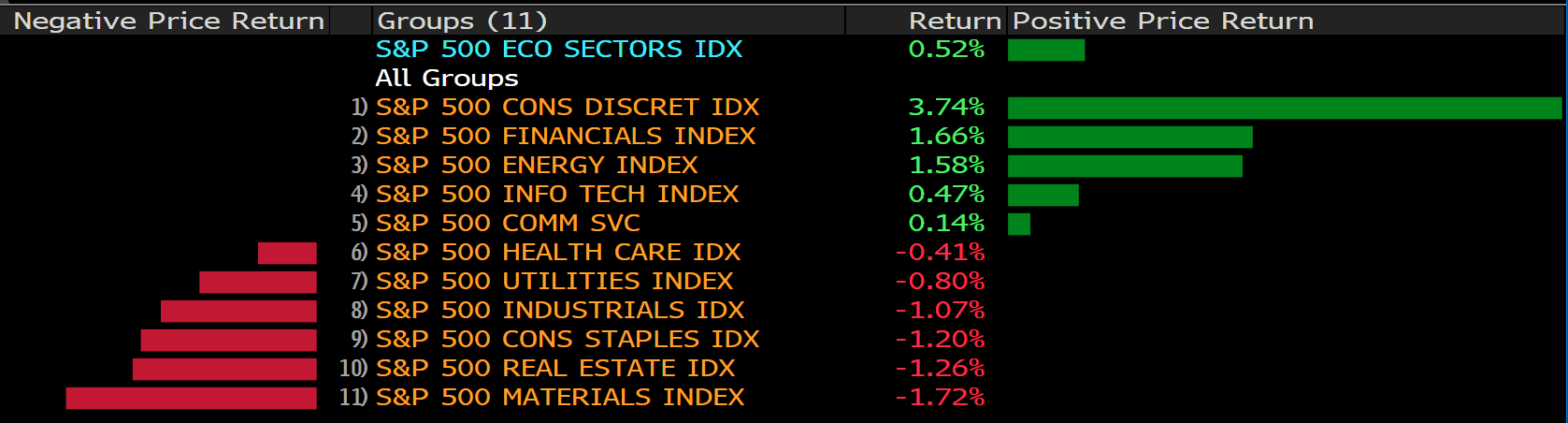

Stocks shifted earlier losses to mostly rise Friday afternoon even as investors viewed a much stronger-than-expected jobs report as strengthing the case for the Federal Reserve to continue down its more hawkish monetary policy route. The S&P 500 went higher during intraday trading, closing up 0.52% at 4,500.61, while the Dow Jones lost steam to close at 35,089.15, slightly down 0.06%. The Nasdaq also rose by 1.58% to 14,098.01.

Inflationary pressures in the U.S. continued to heat up at the start of the year, data are expected to show, likely putting a Federal Reserve interest-rate increase next month on autopilot. The consumer price index (CPI) probably jumped 7.3% in January from a year ago, the largest annual advance since early 1982, according to the median projection in a survey of Wall Street economists. Excluding volatile energy and food categories, the core CPI is anticipated to have risen 5.9%.

The inflation data rose in tandem with the government’s latest employment report, which showed newfound momentum in the labor market and faster wage growth that spurred bets that the Fed will be more aggressive in raising rates.

It’s a light week for Fed-speak. The relative silence from Washington probably reflects the fact that both Powell and Governor Lael Brainard await Senate confirmation — Powell for another four years at the helm, and Brainard to become vice chair.

Elsewhere, Russia’s central bank may increase rates by 100 basis points, perhaps the biggest move in another week of anticipated global tightening by monetary officials from Poland to Peru.

Main Pairs Movement:

U.S. dollar traded mixed against its Group-of-10 peers in early Sydney trade Monday.

EUR/USD rises 0.1% to 1.1462; on Friday, spot posted its best week since March 2020, climbing 2.7%. AUD/USD adds 0.1% to 0.7081 after closing the day 1% lower in New York, trimming its weekly advance to 1.2%. NZD/USD quoted 0.4% lower to 0.6610 amid thin price action given that New Zealand markets are closed for a public holiday. USD/JPY steady at 115.29; closed up 0.3% on Friday for a second day of gains.

As to commodities, gold advanced 0.17% amid choppy trades on Friday, and sliver’s price action acted in line with the yellow metal, though with greater volatility, up 0.46% intraday. Crude oil prices continued to post fresh highs as the Ukraine-Russia conflict upgraded day-by-day. WTI surged 1.98% to $91.95, and Brent jumped 1.92% to $92.74.

Cryptocurrencies got a huge lift on Friday. Bitcoin skyrocketed 11.42% to $41574.25, while Ethereum mounted 11.11% to $2994.99.

Technical Analysis:

The EUR/USD pair edged lower on Friday, taking a break after previous day’s rally amid ECB President Christine Lagarde’s hawkish comments. The pair stayed relatively quiet during Asian session, flirting with 1.144~1.148 area. The pair was last seen trading at 1.1427, posting a 0.06% loss on a daily basis. EUR/USD stays in the negative territory amid the recovering US dollar, as the US Nonfarm Payrolls (NFP) beat estimates and rose by 467K in January, pushing the DXY index above the 95.50 level. The much stronger than expected job data provided support to the greenback and weighed on EUR/USD pair, which surrendered most of its daily gains. In Europe, the hawkish message from the ECB event yesterday might keep acting as a tailwind for the Euros, as investors now expect a potential ECB lift-off in September or December.

For technical aspect, RSI indicator 70 figures as of writing, suggesting that the pair is in overbought zone now, a rend reversal could be expected. Looking at the Bollinger Bands, the price dropped towards the moving average after touching the upper band, which indicates that the pair could remain its downside traction. In conclusion, we think market will be bearish as long as long as the 1.1479 resistance holds. The pair might need to make a technical correction before climbing higher.

Resistance: 1.1479, 1.1599

Support: 1.1284, 1.1196, 1.1132

The pair GBP/USD declined on Friday, continuing to suffer from its heavy intraday losses following the release of the US Nonfarm Payrolls. The pair was surrounded by bearish momentum most of the day, dropping to a daily low below 1.3520 mark and snapped five days of the winning streak. At the time of writing, the cable stays in negative territory with a 0.51% loss for the day, witnessing some profit-taking movement. The Bank of England’s decision to raise the benchmark interest rate by 25bps to 0.50% had pushed the cable to its strongest level in two weeks at 1.362 yesterday. But BOE Governor Andrew Bailey said that rate hikes was mainly due to concerns about inflation, instead of the better UK economy.

For technical aspect, RSI indicator 47 figures as of writing, suggesting that the downside appears more favored as the RSI sits below the midline. Meanwhile the Bollinger Bands showed the pair had crossed below the moving average, therefore the downside momentum should persist. The MACD indicator also have a negative histogram. In conclusion, we think market will be bearish as the pair failed to break the 1.3608 resistance. The risk-off market mood and rebounding US dollar might continue to weigh on the pair in the near-term.

Resistance: 1.3608, 1.3739

Support: 1.3456, 1.3372

USDCAD (4- Hour Chart)

The pair USD/CAD remained its upside momentum on Friday, attracting some buying for the second successive day despite surging oil prices. The pair was trading higher in Asian session and soared above the 1.277 level after the release of US jod data, now looking steadily around weekly tops. The bullish momentum witnessed in USD/CAD is caused by renewed US dollar strength, as the pair is currently rising 0.67% on a daily basis. An uptick in US Treasury bond yields, along with the cautious market sentiment both extended some support to the USD/CAD pair. On top of that, the crude oil has reached seven-year highs at $93.00/barrel amid the winter storm that recently hit the US. The tensions between Ukraine and Russia also sent the black gold higher.

For technical aspect, RSI indicator 63 figures as of writing, suggesting bull movement ahead. But for the Bollinger Bands, the pair moved immediately back inside the band after moving out of the bands, therefore an downside movement could be expected. In conclusion, we think market will be slightly bearish as long as the pair struggled to break above the 1.2790 mark at the moment, appearing to run out of bullish momentum due to skyrocketing oil prices.

Resistance: 1.2790, 1.2941

Support: 1.2669, 1.2575, 1.2461

Economic Data:

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

AUD |

Retail Sales (MoM) (Jan) |

08:30 |

||